Diversification is a way for investors to reduce risk and increase returns. It means spreading your investments across different types of assets, industries, and regions. This way, if one investment does poorly, it won’t hurt your portfolio as much. A balanced portfolio is less affected by market changes.

In this blog, we’ll discuss how to diversify your investments like a pro and why it’s important.

Understand the Basics of Diversification:

Diversification means not putting all your eggs in one basket. If you only invest in one stock or type of asset, its success or failure will affect your finances a lot. But if you spread your money across different assets, you reduce the risk of big losses. This helps protect your investments, especially during bad times in the market.

Diversification means having different investments because they do well at different times. For example, stocks might do well when the economy is good, but bonds can be safer when the market is bad. By mixing your investments, you lower the risk of all losing value at once.

Identify Your Risk Tolerance:

Before you start diversifying, it’s important to understand your risk tolerance. This refers to the level of risk you are willing and able to take on in your investments. People who can handle a lot of risk might like investing in things that go up and down a lot, like stocks. Those who don’t like much risk might choose safer investments like bonds or real estate. Knowing how much risk you can handle will help you decide where to put your money. It’s about finding a balance that works for you, so your investments fit your comfort level

If you are young and have time to invest, you might take more risks for higher returns. If you are close to retiring or need to save money, you might pick safer investments that don’t grow as fast but are stable. Knowing your age and investment time helps you decide how much risk to take

Invest Across Different Asset Classes:

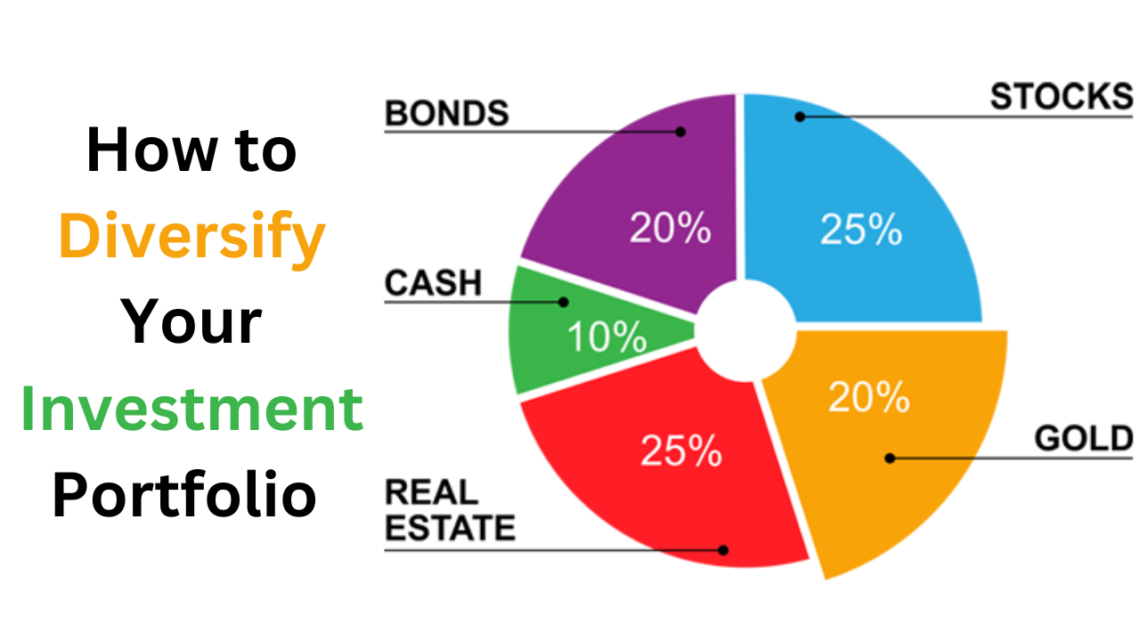

Diversify by investing in different types of assets like stocks, bonds, real estate, and cash. Each type has its own risks and rewards. By spreading your money across these different assets, you can balance your investments. This way, if one investment doesn’t do well, others might do better, protecting your overall money.

Stocks can change a lot but may give good returns over time. Bonds are steadier and give regular income, but their returns are lower. Real estate gives both income and can grow in value. Cash equivalents, like money market funds, are safe and easy to access, but their returns are low.

By investing in different types of assets like stocks, bonds, real estate, and cash, you create a strong portfolio. This means your investments can do well in different market conditions. For example, during bad times, bonds and cash can be safe and stable. During good times, stocks and real estate can grow and make more money. Mixing your investments helps balance the risks and rewards.

Consider Geographic Diversification:

Geographic diversification means investing in different parts of the world to reduce risk. Different countries have different economic conditions. By investing globally, you can find growth opportunities outside your own country. This way, if one country’s economy is not doing well, your investments in other regions can still grow. It helps balance your investments and protect against problems in a single country.

If you only invest in US stocks, your money depends a lot on the US economy. But if you add international stocks or mutual funds that invest in other places like Europe and Asia, you spread the risk. This means if one region has problems, your investments in other regions can still do well. It helps balance and protect your money

Geographic diversification helps you enjoy growth in different parts of the world. If the US economy is weak, investing in growing regions like Asia or Africa can give better returns. By spreading your investments, you balance and protect your money

Diversify Within Sectors:

Sector diversification means investing in different industries like technology, healthcare, finance, and energy. Different industries do well at different times. By spreading your money, you lower the risk of one industry’s bad performance hurting your investments

If you only invest in tech stocks, your money might suffer if tech does poorly. But by also investing in healthcare, consumer goods, or utilities, you lower the risk. A balanced portfolio with multiple sectors helps protect your money from problems in one part of the market.

Consider Alternative Investments:

Alternative investments are non-traditional assets. These include real estate, private equity, hedge funds, gold, and cryptocurrencies. They can be riskier but might offer higher returns, especially when regular markets are not doing well

For example, real estate can provide both income through rent and potential price appreciation, offering a hedge against inflation. Gold, on the other hand, has historically been a safe-haven asset during times of economic uncertainty, and commodities like oil and agricultural products can benefit from specific market trends.

Cryptocurrencies, while highly volatile, have gained popularity in recent years as a potential store of value and hedge against traditional market fluctuations. As with any investment, it’s important to research and understand the risks involved before adding alternative investments to your portfolio.

Review and Rebalance:

Diversification is not a one-time task; it requires ongoing attention. Over time, some of your investments may grow faster than others, which can lead to an imbalance in your portfolio. For example, if stocks have performed well and now represent a larger portion of your portfolio than intended, you may need to sell some stocks and invest the proceeds in other asset classes to maintain your desired diversification.

Rebalancing your portfolio ensures that your investments remain aligned with your risk tolerance and financial goals. It’s a good idea to review your portfolio at least once a year to make sure it’s still on track and adjust your holdings as needed.

Conclusion:

In conclusion, diversifying your investment portfolio like a pro is all about balancing risk and reward by spreading your investments across different asset classes, sectors, and geographical regions. By understanding your risk tolerance and strategically allocating your investments, you can reduce the impact of market volatility and position yourself for long-term success.

Remember that diversification doesn’t guarantee profits or protect against losses, but it can help you build a more resilient portfolio that stands up to the ups and downs of the market. Stay informed, review your portfolio regularly, and continue learning about new investment opportunities to ensure that your portfolio remains well-diversified and aligned with your financial goals.